Bitcoin Transaction Fees Surge to 20-month Highs: What It Means for You

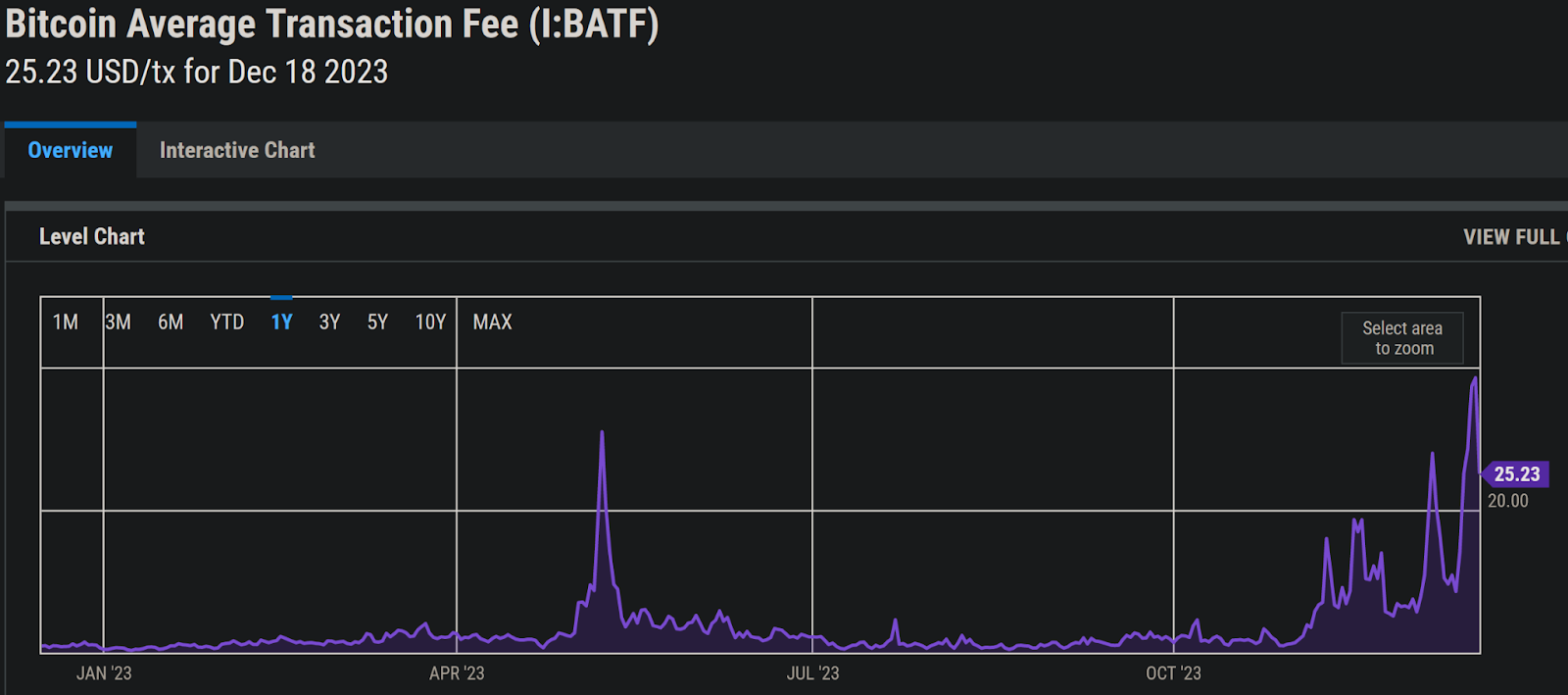

Over the past week, Bitcoin transaction fees have surged to levels not seen since April 2021, when BTC was over $59,000, a development that has significant implications for Bitcoin investors.

This article delves into the current state of Bitcoin fees and how savvy investors are navigating this landscape and buying Bitcoin with the lowest possible fees!

Understanding the Surge in Transaction Fees

Before diving into solutions, it’s essential to grasp why Bitcoin’s transaction fees are climbing. Transaction fees paid to miners on the Bitcoin network have spiked, with the average fee now exceeding $25, down from highs of $38 on December 17th.

Bitcoin Average Transaction Fee Price Chart

This increase is partly due to the rising demand for block space, attributed to the popularity of trading BRC-20 tokens and inscriptions on the Bitcoin Ordinals protocol.

The Impact on Bitcoin Users

For regular users, this means higher costs for sending and receiving Bitcoin. However, it’s crucial to understand how these fees work.

Bitcoin transaction fees are paid to miners for processing transactions and securing the blockchain network. Higher fees can lead to quicker confirmations but can also be a deterrent for small transactions.

Xcoins: A Cost-Effective Solution

At Xcoins, we understand the importance of keeping transaction costs as low as possible for our customers.That’s why we’ve developed a system that significantly reduces the transaction fees you pay when buying Bitcoin.

How Xcoins Reduces Your Costs

- Batching Transactions: We batch transactions between customers. This means we combine multiple transactions into one.

- Passing Savings to Customers: By batching transactions, we can divide the Bitcoin transaction fee among our customers, ensuring that each customer pays only a fraction of the total Bitcoin network fee.

- Faster Bitcoin Receipt: We specialize in delivering Bitcoin to our customers faster than our competitors. By selecting “normal” instead of “fast” when completing your order, you can still receive your Bitcoin in approximately ten minutes.

Xcoins: No verification required for cryptocurrency purchases up to $150 >>>

The Xcoins Advantage in the Current Market

Given the current high-fee environment, Xcoins’ approach offers a considerable advantage. While others are paying hefty fees for each transaction, Xcoins customers enjoy a more economical and efficient process.

This makes now an opportune time to buy Bitcoin through Xcoins.

Why Choose Xcoins Now?

- Cost Efficiency: Save on transaction fees compared to the hefty fees paid for direct blockchain transactions on comparable non-custodial Bitcoin exchanges.

- Speed: Receive your Bitcoin swiftly, often within ten minutes, even when you opt to pay lower fees.

- Safety: Trust in a secure, non-custodial service that prioritizes your safety, privacy, and financial autonomy.

Navigating High Fee Periods with Xcoins

While Xcoins strives to minimize your transaction costs as much as possible through our batching process, it’s important to understand that in times of high network fees, the transaction costs, though lower than elsewhere, will also be higher than at times of low blockchain congestion.

Here are some strategies to effectively manage and minimize these fees:

Smart Buying Strategies

- Consolidate Your Purchases: Consider buying less frequently but in larger amounts. This approach reduces the number of transactions and, consequently, the total fees paid over time.

- Explore Altcoins: Alternatives like Litecoin (LTC), Dogecoin (DOGE), Bitcoin Cash, and Ripple (XRP) could be excellent choices, as they typically come with much lower transaction fees. During high Bitcoin fee periods, diversifying your portfolio with these altcoins can be both cost-effective and strategically sound.

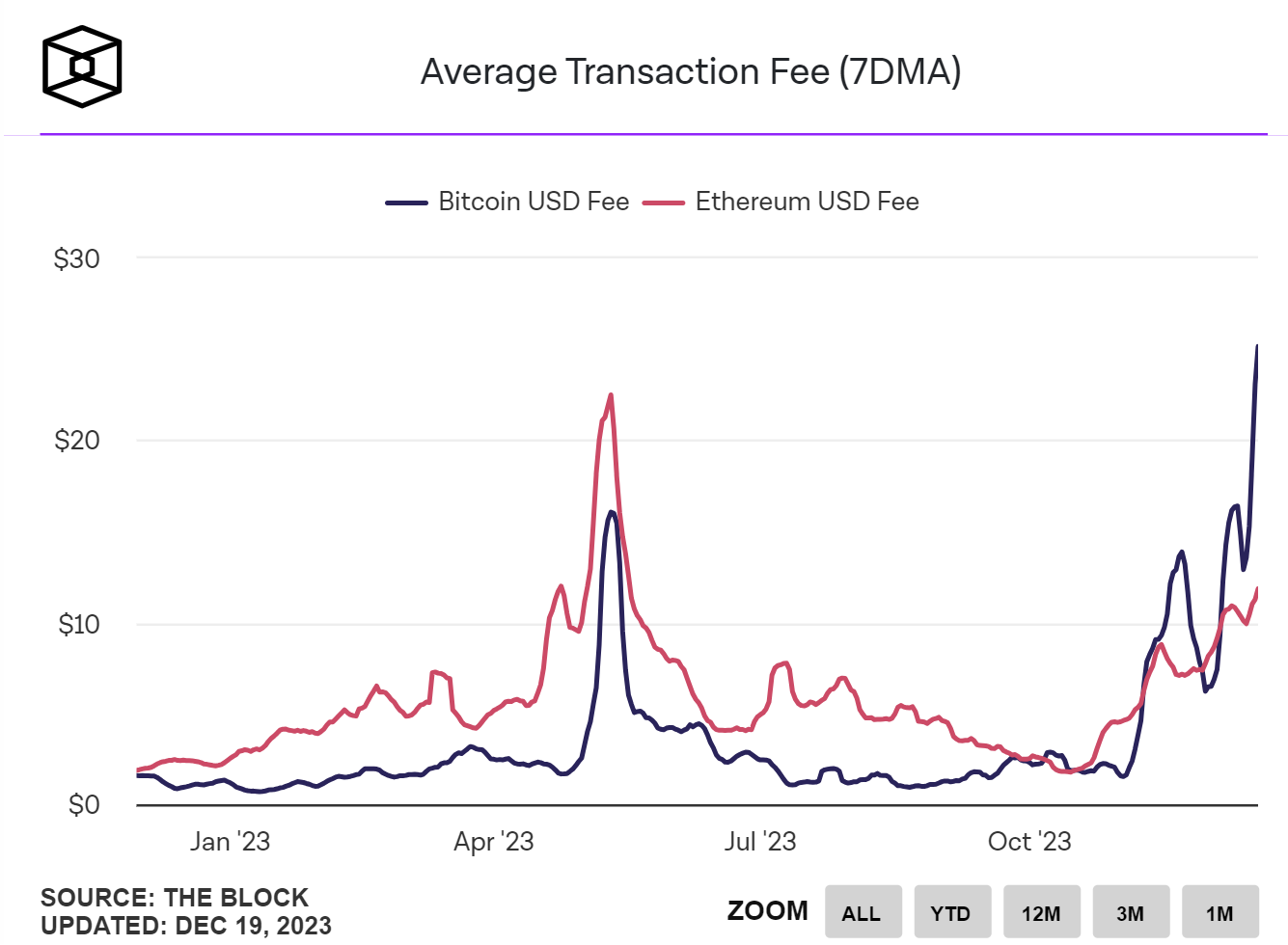

- Consider Ethereum (ETH): Ethereum typically has higher fees than Bitcoin, but in the past five days, ETH fees have been lower than those for Bitcoin, making it an opportune time to consider buying Ethereum!

Bitcoin Transaction Fees Vs ETH Transaction Fees Chart

Understanding Market Trends

Periods of high Bitcoin fees often lead up to what’s known in the crypto community as “altseasons” – times when the value of alternative cryptocurrencies tends to skyrocket. These periods can be prime opportunities for investing in altcoins, as investors look for more cost-effective options than Bitcoin.

Strategic Approach in High Fee Scenarios

Adopting these strategies can help you navigate through periods of high Bitcoin transaction fees with minimal impact on your investment costs. By planning your Bitcoin purchases, considering alternative cryptocurrencies, and staying attuned to market trends, you can make more informed decisions and optimize your investments, even in challenging fee environments.

Xcoins remains committed to providing you with the best possible transaction experience, keeping fees low and transaction times swift, no matter the market conditions. We encourage you to use these strategies to continue enjoying the benefits of cryptocurrency trading with Xcoins.

The Bottom Line for Bitcoin Buyers

The recent surge in Bitcoin transaction fees highlights the need for cost-effective solutions like Xcoins. By choosing Xcoins for your Bitcoin purchases, you benefit from lower fees, quicker transaction times, and a secure, customer-centric platform.

As the Bitcoin market continues to evolve, staying informed and choosing the right platforms for your transactions is crucial. Xcoins not only offers a solution to the current high fee challenge but also represents a smart choice for those looking to buy Bitcoin efficiently and economically.

Buy Bitcoin with confidence at Xcoins and buy Bitcoin with minimal fees, maximum speed, and the reliability you deserve, with confidence and cost-efficiency!

As always, this article does not constitute financial advice. You should be sure to do your own research and consult a professional financial advisor before making a major investment decision.