Coinplate: Where Are Your Coins Really Stored?

Unveiling the Mystery of Crypto Wallets: Where Are Your Coins Really Stored?

I. Introduction

Just picture this: You’ve recently delved into the fascinating world of cryptocurrencies. You’ve got some Bitcoin, maybe a little Ethereum, and you’re keeping it all in a shiny new digital wallet. But do you ever wonder where your coins really are? If you think they’re stored in your digital wallet, well, you’re not alone. This is a common misconception that often leads to a great deal of confusion about the nature of cryptocurrency storage.

The concept of a ‘wallet’ in the crypto world is quite a bit different from the physical one you might have in your pocket right now. Its function and importance, however, are equally significant in the realm of digital currencies. Cryptocurrencies are changing the way we think about and interact with money, and digital wallets are a big part of that shift.

In this article, we’re going to pull back the curtain on the mystery that surrounds crypto wallets. We’ll dive deep into how they function, their role in cryptocurrency transactions, and most importantly, the critical importance of backup and security. By the end, you’ll have a clear understanding of where your coins really are and how to keep them secure.

II. Understanding Cryptocurrency Transactions

When it comes to cryptocurrency transactions, think of it as a kind of digital ballet. It’s a carefully orchestrated exchange involving public and private keys, and it’s these keys, rather than physical coins, that are central to the process.

Here’s how it works: Your public key is like your mailbox address; anyone can send you cryptocurrencies to this address. But to access and spend those coins, you need a private key – a kind of secret password only you should know. It’s this interplay between public and private keys that enables cryptocurrency transactions to happen.

All these transactions are recorded on something called a blockchain – a sort of public ledger that’s transparent and virtually tamper-proof. It’s blockchain technology that keeps the system secure and trustworthy, and each coin’s blockchain records every transaction ever made with that coin.

But what about ‘ownership’ of a cryptocurrency? It’s an interesting concept in the digital age. When you ‘own’ a cryptocurrency, what you really have is the private key to access a particular address on the blockchain. That address has a specific value associated with it – the amount of cryptocurrency you ‘own’. So, as you can see, ‘storing’ your coins in a wallet is a bit of a misnomer, but more on that later.

That’s a glimpse into the world of cryptocurrency transactions. But there’s more to it, especially when it comes to the role of wallets in managing these keys and transactions.

III. Unpacking the Crypto Wallet

So, let’s get into the heart of the matter: the cryptocurrency wallet. If we’re being precise, your wallet doesn’t store your cryptocurrencies. What it does is manage the keys associated with them – the private and public keys we talked about earlier. Your wallet is more of a keychain, securely storing your keys and making them readily available for when you need to access your coins or make transactions.

There’s quite a variety when it comes to cryptocurrency wallets. Some are online, connected to the internet and offering convenience at the potential cost of security. Others are offline, or ‘cold,’ providing increased security by keeping your keys away from potential online threats. You’ll also find wallets classified as software, which run on your computer or mobile device, and hardware wallets, physical devices designed to store your keys securely offline. Each type has its pros and cons, and the choice often comes down to a trade-off between convenience and security.

Here’s how your crypto wallet operates: When you want to access or spend your coins, your wallet uses your private key to sign a transaction, proving it’s you who’s initiating it. And since it’s all about the keys rather than the coins, the phrase ‘storing your coins in a wallet’ can be a little misleading. Remember, your coins are recorded on the blockchain, and your wallet simply manages the keys you need to access and move them.

IV. The Importance of Secure Key Management

Let’s talk about the elephant in the room: security. Remember that private key we’ve been discussing? It’s like the key to a safety deposit box, only much more critical because there’s no bank manager to call if you lose it. You alone are responsible for keeping it safe. If it falls into the wrong hands, your cryptocurrencies could be spent without your consent.

Losing access to your crypto wallet can happen in a few ways: You could forget your password, your hardware wallet could be damaged or lost, or your private key could be stolen in a security breach. Any of these scenarios could result in loss of access to your coins, and since there’s no central authority to step in and help, you’re pretty much out of luck unless you’ve taken the right precautions.

That’s where the wallet backup process comes into play, with a focus on the seed phrase. A seed phrase is like a master key to your wallet. It’s a series of words that can be used to recover your wallet, and therefore your coins, if you lose access to your private key. That’s why securely backing up your seed phrase is one of the most critical steps you can take in managing your cryptocurrencies securely.

V. Safeguarding Your Seed Phrase: The Essential Backup

Let’s delve a little deeper into this idea of a seed phrase. A seed phrase, also known as a recovery phrase or backup phrase, is a list of words which store all the information needed to recover a Bitcoin wallet or other cryptocurrency wallets. Imagine it as the last line of defence, or rather, the ultimate recovery tool if you lose access to your wallet.

The role of a seed phrase in wallet recovery cannot be understated. It’s your lifeline. Should you lose your private key or access to your wallet for any reason, your seed phrase is the only way you can reclaim your cryptocurrencies. No seed phrase, no recovery. It’s as simple as that.

When it comes to storing your seed phrase, security is paramount. One might think to simply jot it down in a document on their computer or a piece of paper, but these methods carry significant risks. Digital copies can fall prey to hacking or data loss, while a piece of paper is vulnerable to physical hazards like fire or water damage.

Instead, consider the best practices for securely storing your seed phrase. Ideally, you want to keep it offline, in a secure location only you know about. Durable, fireproof, and waterproof containers can be a good choice. Avoid making digital copies or taking photos, which could be hacked or stolen.

That’s where products like Coinplate come in. Coinplate offers ultra-durable metal crypto wallets, specifically designed to keep your seed phrase safe and secure. Made with materials that can withstand extreme conditions, a Coinplate wallet provides a robust and secure way to store your seed phrase. It adds an extra layer of security and gives you peace of mind knowing that your lifeline to your cryptocurrencies is well-protected. Think of it as a safety deposit box, specifically crafted for your digital wealth. It’s a small investment that offers a big payoff: the security of your cryptocurrencies.

VI. Conclusion

As we conclude our exploration into the world of cryptocurrency storage, let’s take a moment to recap. Your crypto wallet doesn’t store your coins; instead, it manages the keys that allow you to access and transact with your digital currencies. These keys, particularly your private key, are the true gatekeepers of your digital wealth.

The security of your private key and your seed phrase, the backup key to your wallet, is paramount. Losing them can mean losing access to your cryptocurrencies, with no central authority to turn to for recovery. That’s why having a secure, reliable method to store your seed phrase is essential.

Consider investing in a robust backup solution like Coinplate’s metal crypto wallets. It’s about ensuring the longevity and security of your seed phrase, providing you the peace of mind that comes from knowing your digital wealth is well-protected.

VII. Coinplate Product Line

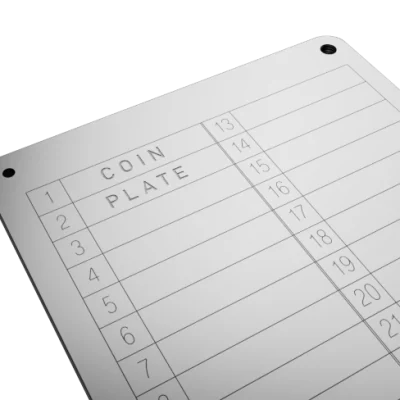

Coinplate Alpha

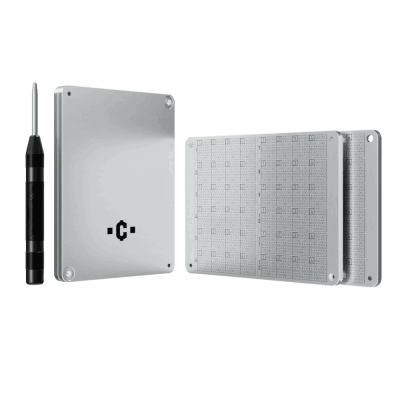

Coinplate Alpha is the ultimate steel crypto wallet. Our best and easiest to use solution to secure your seed phrase. It’s an ultimate seed phrase storage solution.Ultra thick stainless steel sandwich to protect your seed phrase. No tools needed, center punch included.100% Stainless Steel

Fireproof • Hackerproof • Ultra Durable

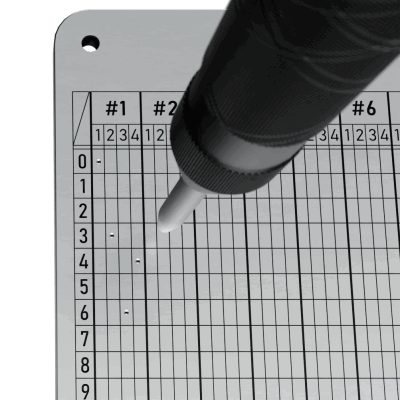

Coinplate Grid

Coinplate Grid: Backup your seed phrase with a little bit of encryption.Mark each of your seed phrase words as their corresponding number on BIP39 wordlist.

Less obvious if found. Whole seed phrase on single side,100% Stainless Steel crypto wallet

Fireproof • Hackerproof • Ultra DurableNo extra tools needed.

All you need is included in the set.

Coinplate Punch

Coinplate Punch: Use stamps and hammer to mark your seed phrase in stainless steel.

Features 24 blank spaces for your seed words plus 4 additional spaces for passphrase or other information.

Made of 2 stainless steel plates bolted with screws to secure your seed.

100% Stainless Steel crypto wallet.

Fireproof • Hackerproof • Ultra Durable.

You can add set of stamps or an electric engraver tool to the bundle.

VIII. Frequently Asked Questions (FAQs)

A. Do I physically ‘own’ any coins in my crypto wallet?

No, your wallet doesn’t physically store any coins. Instead, it holds the keys that allow you to access your digital currencies on the blockchain. When we talk about ‘owning’ cryptocurrency, we mean owning the private key that lets you access a particular address on the blockchain, where the amount of cryptocurrency you ‘own’ is recorded.

B. Can I recover my cryptocurrencies if I lose my wallet access?

Yes, but only if you’ve backed up your seed phrase. The seed phrase is a list of words that can recover your wallet, and therefore your coins, if you lose access to your private key. Without your seed phrase, you won’t be able to regain access to your cryptocurrencies.

C. Why should I consider a metal crypto wallet for storing my seed phrase?

Metal crypto wallets, like Coinplate, offer a robust and secure solution for storing your seed phrase. They are resistant to fire, water, and corrosion, providing longevity and durability. Storing your seed phrase in such a wallet keeps it safe from both physical and digital threats, ensuring that your backup key is protected no matter what.

Author: Adam, Coinplate.com